18 de julio 2019

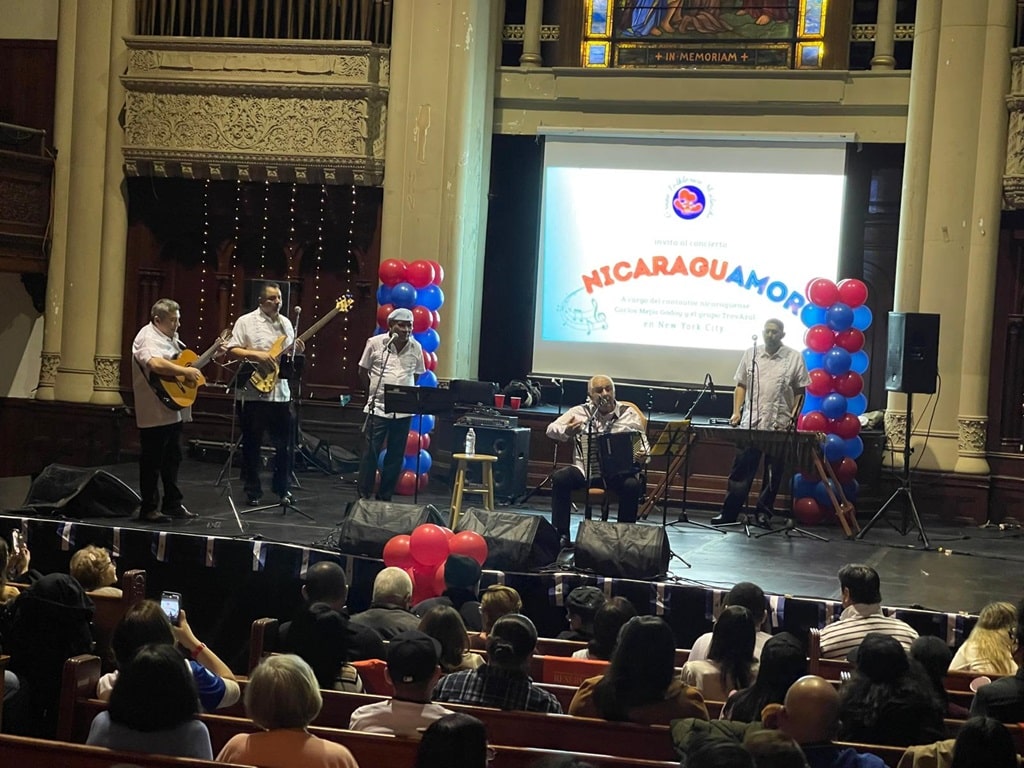

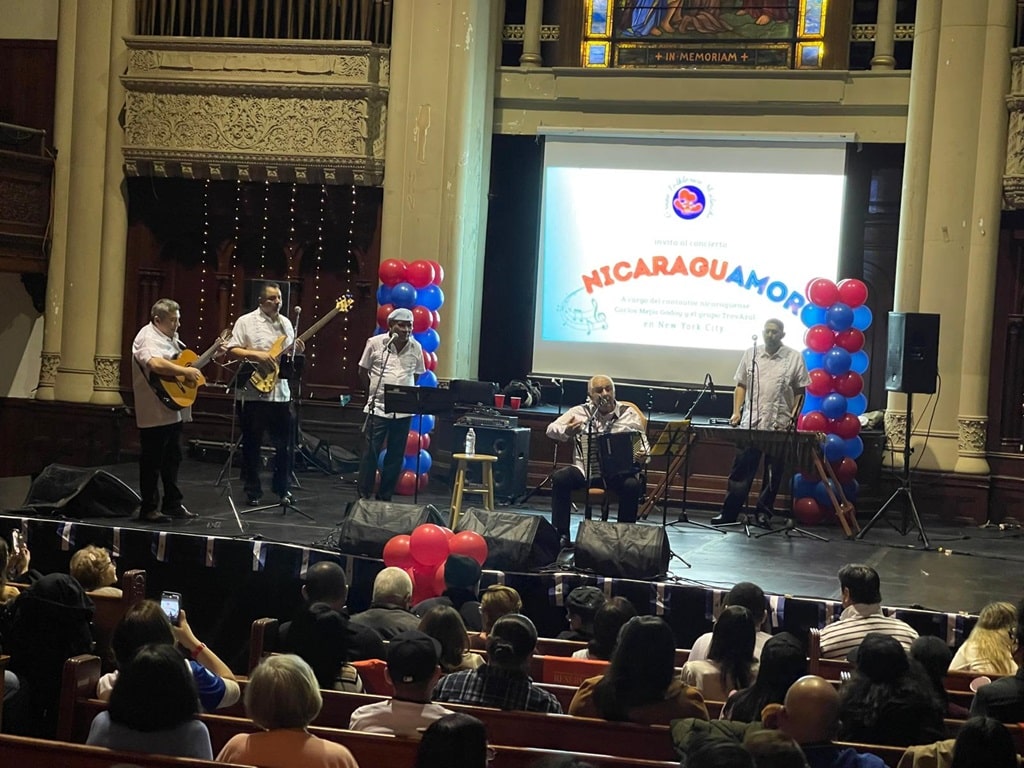

“NicaraguAmor” Cultural Caravan for Nicaraguans in the USA

PUBLICIDAD 1M

PUBLICIDAD 4D

PUBLICIDAD 5D

There are no buyers, even though the owners are willing to lose part of the price of their houses and land.

FOR SALE: The Real Estate market in Nicaragua has taken a beating. The prices on houses for sale has dropped considerably, but even so the buyers aren’t around.

The value of properties in Nicaragua has fallen between 20% and 30%, as a result of the crisis that has plagued the country for fifteen months, three experts from the legal, stock and financial sector told Confidencial.

The news is bad for the owners (who want to sell) and the banks, developers and real estate companies (who see their business affected). Those who gain something are the buyers who, at this moment, are very few. Others, like those who do not have plans to sell or mortgage, see the issue with irrelevance, but that does not exempt them from the effects.

Of all of them, it is the banks that are most concerned, because their line of business places them in the middle of any of those transactions. In particular, the drop in the value of houses by up to 30%, affects bank loans that are backed by such guarantees.

Guarantees lose value

In general, banks requests as collateral, assets which cover 150% of the value of the credit granted, so that, for a loan of 40,000 dollars, for example, the borrower must offer an asset valued at 60,000 dollars.

When the market value of these assets falls, the loans are partially unsecured. Thus, for example, a drop of 20% (the lower part of the band), will revalue the asset in 48,000 dollars, and would make this hypothetical loan only covered at 120%.

This becomes a problem when the loan recipient falls into default, because the bank is forced to reclassify that client, which implies that the financial institution must increase the money in reserve, which is “frozen,” and cannot be used to give new loans.

Among the options contemplated by the experts, is that the Superintendency of Banks and other financial institutions (Siboif) reduced that percentage of coverage of the value of loans, or make the clients increase the guarantees granted.

The situation in general affects from the small owner who wants to sell his car, to the one who wants to sell his house to leave the country. On the other end of the spectrum, it also harms larger investors who had counted on the real estate business, given that the value of land is much lower in Nicaragua than in other countries in the region.

60,000 dollars less…in one fell swoop

An expert in financial matters, whose line of business requires the highest level of discretion, told Confidencial the case of a property originally valued at more than 300,000 dollars, to which a new appraisal found a 20% lower value.

“Recently, we have not yet evaluated properties of lower value, but I am sure that they should have a bigger blow, percentage-wise speaking,” he asserted.

In the case of the real estate project that he did study, “we saw that the offers that the owners had received for the land which they had for sale, were 20% lower than what was calculated before the start of the crisis,” from where the decrease of 20% in the value of the property was determined.

“Sometimes, the prices are determined by the value at which the surrounding land could have been sold, but in this case we do not use that method,” he said, recalling that, in the end, everything comes down to the game of supply and demand.

“The real estate market is at a standstill. There are no credits, no appetite for this type of assets, which also applies to cars and any other capital asset,” he explained.

This source perceives that “the problem is not of coverage, but that there is no market, which has to be active (that is, that there are enough transactions) and liquidity (money to buy directly, or to finance the respective bank loans to make purchases),” so that everything flows well, he explained.

Anyway, he admits that “a bank that wanted to liquidate this guarantee, could not do it,” although he clarifies that “banks are not interested in keeping the assets,” because it results more expensive. Hence, they are choosing to “restructure in a friendly manner,” without reaching the courts.

“There is a ‘reticence’ to go to the courts, because we already know that they are usually slow and unreliable. In this particular circumstance, the lopsidedness of the judges against the private sector can lead to dictating a sentence that is contrary to the interests” of the bank that filed a lawsuit, he revealed.

Mortgage market is at zero

If banks have to review with a magnifying glass the properties they received as collateral, to see if they still fulfill the 150% requirement, the next sector that is also in permanent distress for what is happening with properties…is the one that does business selling and renting properties.

Rosario de Tefel, President of the Nicaraguan Chamber of Real Estate Brokers (CANIBIR), recognizes that “the crisis has affected us all, because it generates insecurity, both in those who make an investment of a personal nature, and in those who do it as a business.”

She explains that “the lack of mortgage financing to acquire properties, makes people limit themselves, and the market stays at zero sales,” which has even stopped the construction of new housing.

The people who are trying to sell their property understand that there is little demand, so they have lowered prices between 20% to 30%, to make them more attractive to the few potential buyers, “but when they are in a hurry to sell (because they are leaving the country, do not want to lose their houses, or need the money) then the discount is higher,” she stated.

This is somewhat what is happening in the coastal areas, where many people have chosen to sell their homes with much higher discounts, “up to 50% in some specific cases, and there are those who have been able to obtain these bargains, although this type of transaction is not carried out through real estate companies,” because they charge a commission for the transaction, she explained.

These examples are rather the exception, because the only buyers are “those who have funds availability to risk, or a bank that supports them, but no longer wage earners, because they have less certainty of preserving their jobs, or that their businesses could continue to generate enough resources to pay a loan,” she detailed.

By the way, construction and sale of new houses have also stopped, “because financing is quite cautious, although the banks have sufficient liquidity,” she said.

In the case of rents, the premises for rent are being offered with 30% to 50% discount, and even so there are many that are not being placed, because the arrival of the flow of foreigners has decreased. New business are not being installed, in the case of commercial or office premises.

The chamber leader said she knows that banks are only financing repossessed properties, and are not staying with this type of property, “because that does interest them” because their business is money.

Stability is over, and the market fell

A lawyer with extensive experience in the real estate sector, who requested to remain anonymous, reconstructed for Confidencial, the route that put that sector in its current situation.

His first argument is that “there was a boom in the construction of housing,” both high range, as well as low cost, so that “the financial system ended up financing that supply because there was a good demand, and enough people with jobs that classified as subjects of credit.”

Those were the times in which the members of the Chamber of Developers set themselves the goal of selling 5,000 new homes every year. The goal for 2019 was 1,500 houses, but as the first semester passed, the calculations indicate that it could be that they could not even place a thousand houses.

“We must not forget that the sale of real estate is also governed by supply and demand. If there is less demand, combined with an oversupply, prices fall,” he said.

The macroeconomic stability in which the country began to develop, since the administration of former president Enrique Bolanos, “generated an environment that allowed this type of investment, so that real estate supply increased, in a housing deficit environment,” he continued.

Although “this deficit remains,” unemployment increased dramatically, and the country risk increased, consequently, “investment in housing is in the doldrums,” he added.

When referring specifically to the movement in the price of properties, he recalled that “the rise—or the maintenance of prices—occurs when there is a healthy demand, but if demand goes down and the supply remains, then prices go down,” he insisted.

“The valuation experts establish the price of properties, according to the market reality, so that the mortgage guarantee covers at least 150% of the value of the price granted, but as market prices fall, it is possible that the credit coverage be 100% or less of the loan,” admitted the expert.

Thank you for reading our English section, brought to you in collaboration with Havana Times. If you wish to subscribe to our English Weekly Newsletter, you can do it here. Please spread the word and share this link with your friends, family or contacts.

Regards,

Archivado como:

PUBLICIDAD 3M

Periodista nicaragüense, exiliado en Costa Rica. Durante más de veinte años se ha desempeñado en CONFIDENCIAL como periodista de Economía. Antes trabajó en el semanario La Crónica, el diario La Prensa y El Nuevo Diario. Además, ha publicado en el Diario de Hoy, de El Salvador. Ha ganado en dos ocasiones el Premio a la Excelencia en Periodismo Pedro Joaquín Chamorro Cardenal, en Nicaragua.

PUBLICIDAD 3D