23 de marzo 2019

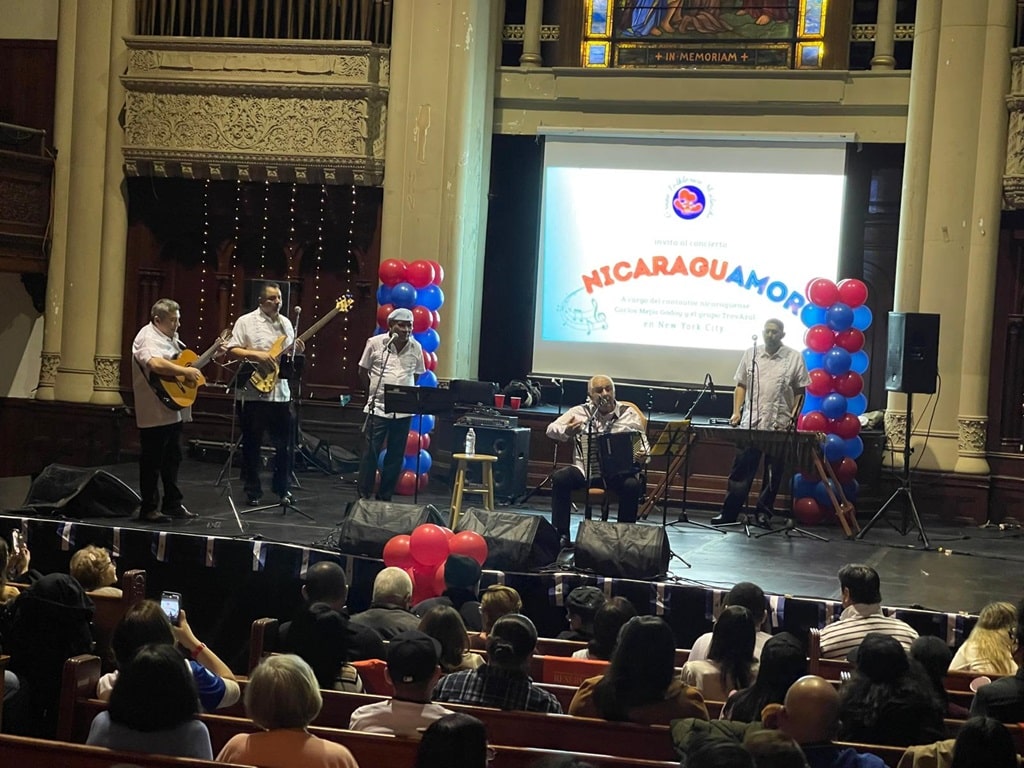

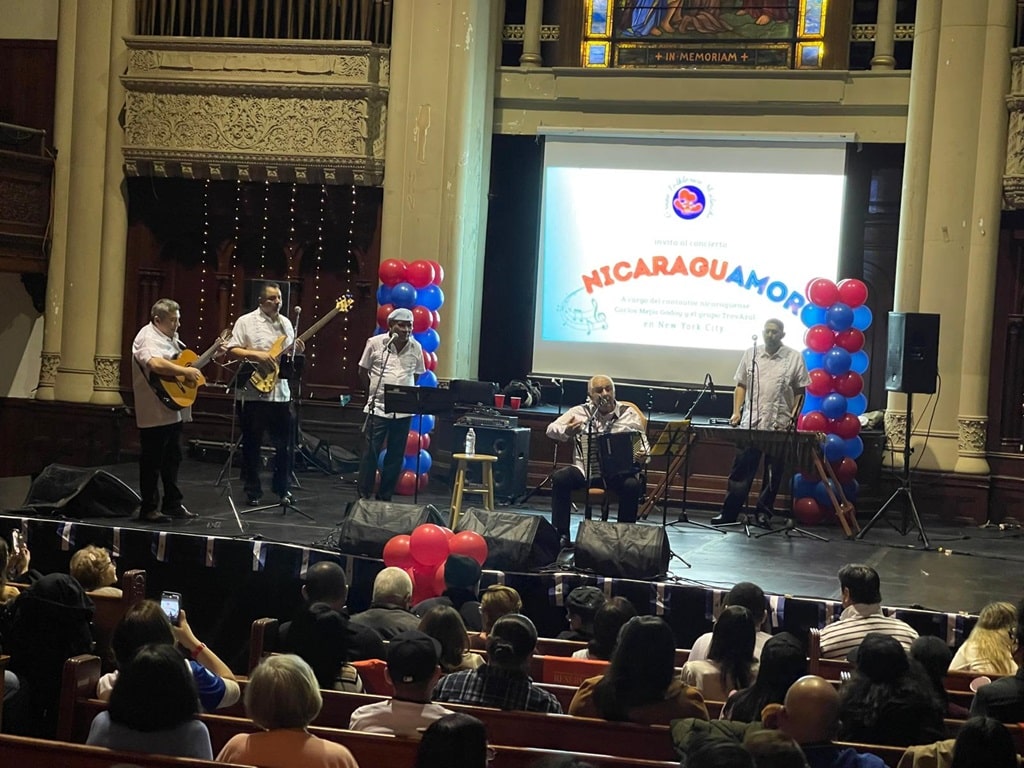

“NicaraguAmor” Cultural Caravan for Nicaraguans in the USA

PUBLICIDAD 1M

PUBLICIDAD 4D

PUBLICIDAD 5D

Possible impacts of US sanctions on popular discontent and loyalty towards Ortega are analyzed, if there is no political agreement.

Possible impacts of US sanctions on popular discontent and loyalty towards Ortega are analyzed

The collapse of the Nicaraguan economy has affected more families as a whole than the national banking system, but no one has been left unscathed.

On the one hand, there are some 415,000 people in unemployment or underemployment, while many Nicaraguans are at risk of returning to poverty. On the other, banking seems to be immersed in a downward economic spiral, warns the essay “Nicaraguan tragedy: from consensus to coercion,” presented on Tuesday at the Wilson Center, located in the US capital.

In the paper, the authors—professor and former official of the State Department Richard Feinberg and researcher Beatriz Miranda—carry out an intense look over the last three decades in the country, to help understand how it was that the April Rebellion was reached.

The article by Feinberg and Miranda was discussed at the Wilson Center in a panel with the participation of Luis Rivas, CEO of Promerica Group and Julie Chung, an official of the US State Department official who accompanied Ambassador McKinley in a meeting with President Daniel Ortega.

“Before the crisis, the IMF had judged that the Nicaraguan banking system was “sound” and “robust,” with levels of capitalization and liquidity well above international standards,” a precaution that provided “some protection against the shocks of mid-2018,” they recognize.

But the economic crisis that followed governmental repression against citizens led to an increase in non-performing loans, a plummeting of profits, and suddenly placing at risk the capital that banks had accumulated for many years.

In their analysis, Feinberg and Miranda warn that “the continuous withdrawal of deposits could lead to a liquidity crisis, so that banks could not fulfill their obligations…and close their doors or seek new owners. Alternatively, the loan losses and the declining profits could wipe out their capital, creating a solvency crisis.

“A total loss of confidence could cost a bank run. So far, deposit withdrawals have proceeded gradually, but in light of the tense political stalemate, an exponential explosive withdrawal of deposits rises as a credible threat,” they explained.

In fact, the lack of sufficient liquidity to face a possible run of deposits, has the banking system in suspense, which for months has restricted credit for almost any type of activity. A decision that now extends to agricultural and fishing production, which threatens this activity on which thousands of jobs depend, as well as local commerce, exports, agroindustry and food security in the country.

Even though “a financial collapse could be caused by the internal situation,” the authors weighed the effect that the US economic sanctions could have, whose “punitive measures” point at the Sandinista leadership, but they can also harm the economy and society in general.

The sanctions against people “seek to force these individuals and other senior officials to reevaluate their ties with the Ortega-Murillo regime.” The decision to oppose the new loans “threatens the economy as a whole to undermine Ortega’s political base,” but if they are sustained, “they will inevitably bring suffering to the average Nicaraguan,” they warn.

Feinberg and Miranda point out that the effectiveness of the sanctions strategy assumes that “Ortega’s apparently firm control over the Sandinista leadership and over the security forces may be affected; that Ortega and his people will respond rationally to popular discontent; and that the political opposition will be able to take advantage of any emerging division to increase its negotiating capacity.”

These sanctions could affect the flows of merchandise and money between the United States and Nicaragua, which places 40% of its exports of products in that country, as well as 70% of the production of the companies that work under free trade regime, without ignoring that some 800 million dollars (55% of the total annual remittances) comes from that country.

“US sanctions against remittances and the export of merchandise (especially in the clothing sector, which is labor-intensive) would directly harm middle class and the poor households,” the scholars warn.

In this regard, they note that the application of economic sanctions that affect the entire country can be counterproductive, because those who have state jobs, or any kind of governmental benefit, will strengthen their loyalty to Ortega, increasing the cohesion of the regime.

Restoring real peace, and putting the national productive apparatus to run—with international financial support—could triple GDP per capita from the $2,161 dollars in 2017, to some $6,700 by 2050. With a greater effort, the next generation could enjoy a GDP per capita six times greater than the current one, concludes the essay by Feinberg and Miranda.

Their summary is simple: yes, economic growth is important; the distribution of wealth, also is. But, it is not enough. Institutions and institutionalism have weight. They mean a lot, and public-private agreements are not enough to make everyone believe that everything is fine.

“As a developing economy, Nicaragua faces many challenges, but the economic model designed over the last 25 years has laid a solid foundation. The keys to future success included sustained macroeconomic discipline, export-led growth, an increasingly diversified export platform, and an openness to foreign investment and multilateral funding,” the document summarizes.

The authors add that “a reasonably equitable distribution of the fruits of growth could be achieved through the combination of a solid job creation, progressive fiscal policies and specific and efficient governmental assistance programs. In the private sector, a more educated and trained workforce, will justify a fairer distribution of productivity gains.”

At the end of the day, the reality was different from the sweetened scenario that the interested parties tried to orchestrate, as was evident when “the events revealed that there was a critical problem, or a set of problems, where there was no consensus: the reforms of the institutions of the public sector.”

“The old mentality that sought to manipulate public office to obtain private and partisan profits had not disappeared. Appropriate relations between the public and private sectors, and between the state apparatus and the main political parties were under discussion,” it relates.

“The independence of the Judicial Sector and the integrity of the electoral process were also in dispute. Hence, the deep political crisis. Nicaragua is living proof that economic growth is not sustainable without a functional consensus on political institutions,” as many voices at different times in the last decade had warned.

Repeating what was advise to the Government of Daniel Ortega, Feinberg and Miranda detail that “Nicaragua desperately needs a political solution credible enough to restore confidence in financial markets, investors and consumers.”

“The most pressing political problems are the reform of the electoral system and the date of the elections, as well as the return of civil liberties and the freedom of political prisoners,” so “more comprehensive government reforms must be followed,” they state.

Warning those who expect solutions in a very short term, the authors emphasize at the beginning “that economic recovery is likely to advance slowly, as the nation recovers from the severe trauma of violent confrontation, and economic actors wait to see if the new political agreements are sustainable.”

“During this transition, the international financial institutions can set up a concerted and fast-disbursing stabilization package, which establishes the conditions for renewed growth,” they proposed.

They refer to entities such as the International Monetary Fund, the World Bank, and the Inter-American Development Bank, which they say have fallen short in three critical aspects: how to face corruption, trusting unreliable official statistics, and not calculating properly the political risk.

Archivado como:

PUBLICIDAD 3M

Periodista nicaragüense, exiliado en Costa Rica. Durante más de veinte años se ha desempeñado en CONFIDENCIAL como periodista de Economía. Antes trabajó en el semanario La Crónica, el diario La Prensa y El Nuevo Diario. Además, ha publicado en el Diario de Hoy, de El Salvador. Ha ganado en dos ocasiones el Premio a la Excelencia en Periodismo Pedro Joaquín Chamorro Cardenal, en Nicaragua.

PUBLICIDAD 3D