25 de agosto 2018

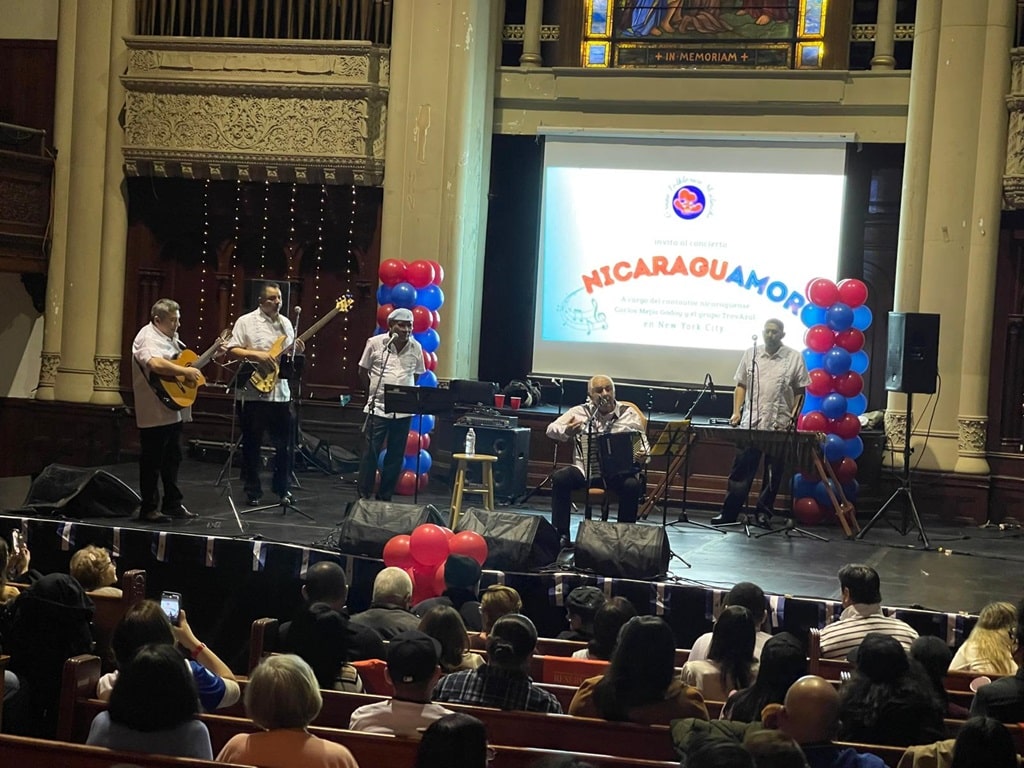

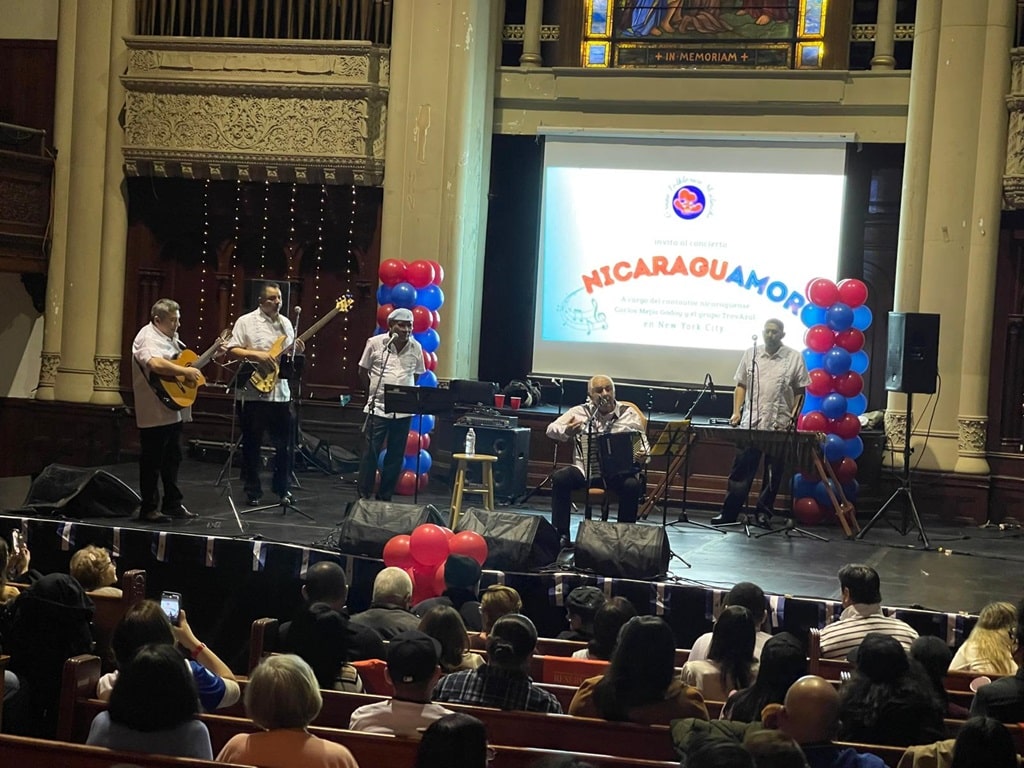

“NicaraguAmor” Cultural Caravan for Nicaraguans in the USA

PUBLICIDAD 1M

PUBLICIDAD 4D

PUBLICIDAD 5D

Lack of financing, land-takeovers and physical and legal insecurity threatens a sector that develops if tourism grows.

The invasion of private property ordered by the ruling party has hardened the difficulties faced by the real estate industry, whose activity is very close to zero, since the national crisis began in April.

“Everything is on stand-by because there is no financing, and because the uncertainty continues about what will happen. People do not know if they will still have a job within some time,” said Rosario de Tefel, President of the Nicaraguan Chamber of Real Estate Brokers (Canibir), when interviewed on the program Esta Noche (Tonight), broadcasted by the local Channel 12 TV.

“The illegal takeover of land has slowed investment on farms and large tracts of land. People are very cautious, and do not want to invest at this moment. We have several cases of people who have stopped investing because of the insecurity,” she added.

“We began to see problems as soon as tourism dropped, the industry to which real estate activity is closely linked. “To this date it has not normalized, which affects all brokers and agents directly, because we cannot do any type of transaction,” explained Rodri Gonzalez, Canibir’s Vice President.

“Tourism generates requirements. In the entire Pacific region there are many real estate developments at the beach, for vacations, as a second home for investors that come to enjoy their retirement. Everything that moves around that is considerable, and the demand for housing and hotel services allows us to place [on the market] not only land but also some buildings,” said Gonzalez.

For real estate brokers, every tourist that arrives in the country is a potential client. “That is how this works. In this case, we are the intermediaries that try to provide legal security to the transaction that takes place between a buyer and a seller,” he added.

Before the crisis, the country registered a large influx of foreigners —mainly from the Central American region— venturing into areas such as tourism, agriculture, investing in farms, construction projects, building houses and in real estate activities, showing a performance that now seems far away.

This economic activity is one more sample of how unrealistic the governing party’s discourse is when it proclaims that everything is normal, and that the country is moving along this path little by little.

“If you want to know if our activity is already “normal”, look at tourism, which is a parameter that marks us directly: if tourism goes up, real estate goes up. If tourism goes down, real estate goes down. Currently, we are in a subsistence stage. The little business we can do allows us to cover the basics, but doesn’t maintain the solidity that we require as generators of this activity,” Gonzales explained.

How much time will it take to recover this “normality”? It is difficult to say, because “it is a process that will cost a lot, because to have legal trustworthiness and security in the country” will take time,” stated Rosario de Tefel.

Rodri Gonzalez described that a partner from the Chamber commented to him that several US citizens left their homes in the eastern part of the country. They left for security reasons, leaving their homes unoccupied.

For them, the option is to sell, if they no longer want to return and if they find a buyer at this moment; or to let the property deteriorate. If they do not return soon to recover their investment; by the time they do it, the house would have lost its value. And, if they want to sell it, it will be difficult to find a local buyer, let alone a foreigner who would want to come right now, Gonzalez explained.

As in other activities, real estate also has its specialties. In this case, Tefel and Gonzalez detailed what occurs with the rental and sales of houses, offices and commercial spaces, although the general picture is very sad.

“Practically, since the crisis started in April, the movement of property sales and rentals dropped to zero,” declared Gonzalez.

Mrs. Tefel said that what has most affected the sale of home is the lack of credit. “When people buy a house, they pay a premium and the rest is financed, but banks are being cautious about giving credit. It could be said that we are at zero, and that affects us directly because people do not have the capacity to buy houses in cash,” she said.

She also explained that, although they are more expensive, closed condominiums are very attractive at times when safety becomes a scarce item. “Although that trend came from before, condominiums generate more interest in the population.”

Gonzalez said that although they do not have statistics to know if there are many homeowners who have lost their homes due to the impossibility of paying their loans, they do know that banks are open to restructuring mortgages. This has allowed people to reach some kind of arrangement that lets them preserve their homes.

“We know that banks are offering some extensions and changing the conditions, because they have listened to the needs of the people,” she explained.

The situation is not very different in the field of renting commercial spaces, where “some movements are taking place that have not yet reached the levels we had before the crisis began. But, it does affect some minor operations, because many small companies that had their businesses in commercial centers, or in other places adequate for doing business, closed down because they could not sustain themselves under this crisis,” detailed Gonzalez.

The perspective of seeing these rental properties empty has led owners to respond to this new reality by lowering the rent price, attracting some clients interested in renting under those conditions, but at a rate that at this moment is only around 10% of what this sector generated before the crisis.

Given the low demand, the entrepreneurs of this sector realized that they had no choice but to lower rental prices, especially considering that “something is better than nothing, and that an empty place generates maintenance costs and payment of basic services and security,” recalled the Vice President of Canabir.

In the case of office spaces and buildings —of which there were 25 under construction before the start of the crisis— Rosario de Tefel explained that “these initiatives are frozen. People are waiting to see what will happen in the future to decide what they will do about it.”

Remember, she said, “before there was a lot of interest in discontinuing the use of houses and renting space in office buildings,” where there is more security for the personnel and for visitors, and a business environment. “That is the world-wide trend that was beginning to be implemented in Nicaragua, although at this moment it has stopped. We will see what happens later, because right now people are waiting.”

Archivado como:

PUBLICIDAD 3M

Periodista nicaragüense, exiliado en Costa Rica. Durante más de veinte años se ha desempeñado en CONFIDENCIAL como periodista de Economía. Antes trabajó en el semanario La Crónica, el diario La Prensa y El Nuevo Diario. Además, ha publicado en el Diario de Hoy, de El Salvador. Ha ganado en dos ocasiones el Premio a la Excelencia en Periodismo Pedro Joaquín Chamorro Cardenal, en Nicaragua.

PUBLICIDAD 3D